Why efile990t.com is the Right Choice to File your Form 990-T Electronically?

990-T Filing

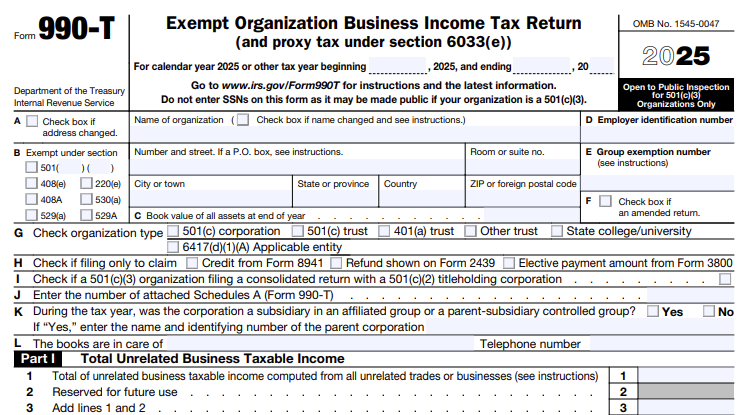

What is Form 990-T?

Form 990-T is used by the exempt organization to figure and report unrelated business income. Exempt organizations with an income of $1000 or more from an unrelated trade or business must file Form 990-T to provide information on Unrelated Business Taxable income.

Visit https://www.expresstaxexempt.com/form-990-t/what-is-form-990-t/ to learn more about Form 990-T.

Form 990-T Due date

Employees' trusts, defined in section 401(a), IRAs (including SEPs and SIMPLEs), Roth IRAs, Coverdell s, or 408(a) (Archer MSAs) must file Form 990-T by the 15th day of the 4th month after the end of their tax year.

Other organizations must file Form 990-T by the 15th day of the 5th month after the end of their tax year.

Note: If the due date falls on a Saturday, Sunday, or legal

holiday, file the form on the

next

business day.

Information Required to

E-file 990-T

The following information is required to

E-file 990-T :

- The organization's name, EIN, address, and phone number

-

Relevant details about any address changes, name changes, or filing an

amended return - Group exemption number

- Organization's tax-exempt status

- If you are only filing Form 990-T to claim a credit from Form 8941 and/or to

claim a refund shown on Form 2439, provide

relevant details. - Form of Organization

- The fair market value of all assets at the end of the year.

- Details of Schedule A attached with

Form 990-T.

For more details, https://www.expresstaxexempt.com/e-file-form-990-t/.

Form 990-T Electronic Filing Requirements

The IRS has mandated electronic filing of Form 990-T. Therefore, effective in 2023, all organizations with a due date on or after April 15, must file their return Form 990-T electronically for the 2023 tax year.

Paper filing is no longer an option. However, there is a limited exception for

2023

IRS

Form 990-T returns submitted on paper and postmarked on or before

March 15.

If the due date falls on a Saturday, Sunday, or legal holiday, file the form on

the

next business day.

E-Filing your Form 990-T is easier when you choose an IRS authorized e-file service provider like Tax 990 . Also, it is more secure than traditional paper filing. The IRS will process the electronic forms more quickly than paper filing, and you will get instant approval once you submit your return.

Form 990-T Schedule A

While filing form 990-T the exempt organization may be required to provide additional information based on the activities performed for the tax year.

Suppose your organization engages in more than one unrelated trade or business. In that case, you will need to complete and attach a separate Schedule A to report income and allowable deduction for each separate unrelated trade or business.

Click here to know more about

Form 990-T Schedule A.

How to E-File Form 990-T Electronically

To file Form 990-T electronically start with efile990t.com and follow the steps below to complete your filing process: